TECHNOLOGY-POWERED CLAIMS

CANADIAN INSURERS WANT TO ADOPT AUTOMATED TECHNOLOGIES, SAYS REUTERS REPORT

Story by Sarah Perkins, Allison Rogers

The Reuters Events Insurance Technology Benchmarking Survey 2024 was conducted between March and April 2024. Among the 47 respondents from Canada, 45 percent are in senior management positions, reporting directly to organizational leadership. A further 34 percent of Canadian respondents are in C-suite or equivalent sector leadership and board membership roles, while 13 percent are in mid-management capacities.

Insurers aren’t employing literal robots (yet), but they are investing in new technologies like generative AI and machine learning, especially in Canada.

Insurance companies are embracing technologically advanced trends like generative AI and machine learning to address industry challenges.

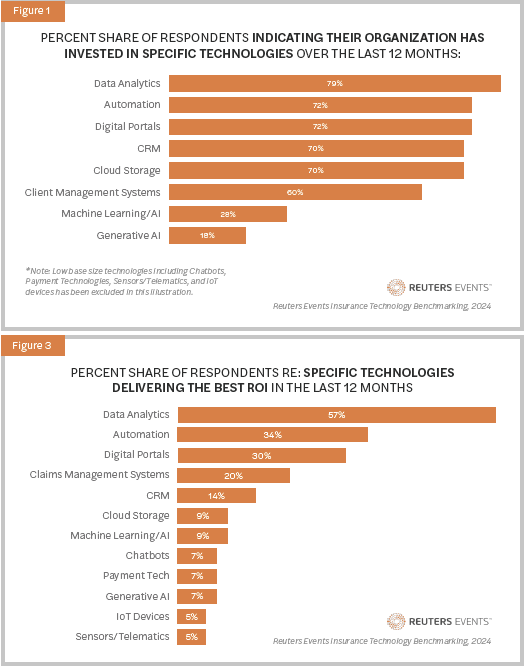

According to Reuters’ recent report, titled The Future of Insurance in Canada: Top Technology Trends in 2024, the majority of Canadian insurance representative respondents indicated that their companies have already invested in “established technologies,” with 79 percent saying their companies have invested in data analytics and 72 percent saying they’ve invested in automation.

The report further notes that exactly 50 percent of Canadian insurers said their organizations are planning to adopt automated technologies like generative AI. Thirtythree percent of respondents indicated their companies are testing scenarios where AI can be used, compared to just 22 percent of insurers globally.

In total, 37 percent of Canadian survey respondents indicated their organization had already used generative AI in test-use cases; had evaluated potential vendors or even moved on to full-scale implementation.

According to Reuters’ analysis, generative AI and machine learning will be the top trending investment by insurance representatives come 2027. In 2024, generative AI and machine learning are the eighth and ninth-most invested in technology by insurers. As of 2024, data analytics are the top-ranked insurer investment, followed by digital portals and automation.

Despite these widespread investments and clear interest in new technologies, 63 percent of respondents indicated that automated claims management systems are particularly difficult to implement. More than half of respondents highlighted delays in implementing technology. A further 46 percent said there was a lack of understanding regarding technology implementation, either on the industry’s part or on the business and vendor side.

“It’s essential that investments [in AI, particularly generative AI] are supported by strong governance frameworks and the adequate training of our people,” noted Markus Glese, chief compliance officer for Zurich. “While AI has the potential to revolutionize operations, it’s ethical and effective implementation depends on ensuring that employees are well-equipped to manage and utilize these advanced tools responsibly, maintaining trust and meeting regulatory standards.”

Comparing both Reuters’ global insurer and Canadian insurer samples, the technologies delivering the best return on investment are data analytics, automation, digital portals and claims management systems.

“Data analytics is unsurprisingly number one in most businesses,” said Brady Aarssen, VP of operations, strategy and transformation for Canada Life. “The industry has a unique and comprehensive data repository that historically we haven’t been able to fully leverage. With new tools and technologies, it opens up a world of possibilities by providing the knowledge needed to run a better business and make better decisions.”

Reuters further points out that data analytics is being applied across multiple insurance processes, unlike other new technologies. Across Canadian respondents, 32 percent apply data analytics to claims; 45 percent apply them in underwriting; 36 percent use data analytics in actuarial practices; 45 percent in pricing and 32 percent in marketing. For comparison, 18 percent said they’ve used automation in claims; 14 percent have used automation in underwriting; zero percent in actuarial; two percent in pricing and 14 percent in marketing.

More than half of Canadian respondents (57 percent) said data analytics is delivering the best return-on-investment today. Globally, respondents ranked data analytics to have the second-best ROI, behind automation. Generative AI and machine learning are ranked to have the lowest ROI, both in Canada and globally, indicating a shared perception of this novel technology across markets.

“Generative AI and other more advanced tools may simply be too novel and unknown for demonstrable implementation plans, while employees may take longer to develop an understanding of them,” noted the report.

WHAT IS GENERATIVE AI?

Think of it as a smart machine that learns from lots of examples and then uses that knowledge to make something new. For instance, if you show it many pictures of auto damage and “teach” the program what it is looking at, it can begin to learn and identify auto damage on pictures you upload to the system. In the insurance world, generative AI could help to write policies, answer customer service inquiries, perform risk assessments or detect fraud.